reit dividend tax philippines

Initial Public Offering of the company on Philippine Stock Exchange was August 13 2020. How most REIT dividends are taxed In the vast majority of cases REIT distributions are mostly made up of ordinary income and are therefore taxable at the investors.

Upcoming Reit Dividends This September 2021 Reit Philippines

Reit dividend tax philippines Monday February 28 2022 Edit.

. Of this 120 of the. ARTICLE I GENERAL PROVISIONS Section 1. This Act shall be known.

What makes C-REIT different than other top REITs. An investor buys a REIT currently trading at 20 per unit. A 20 rate if they are foreign.

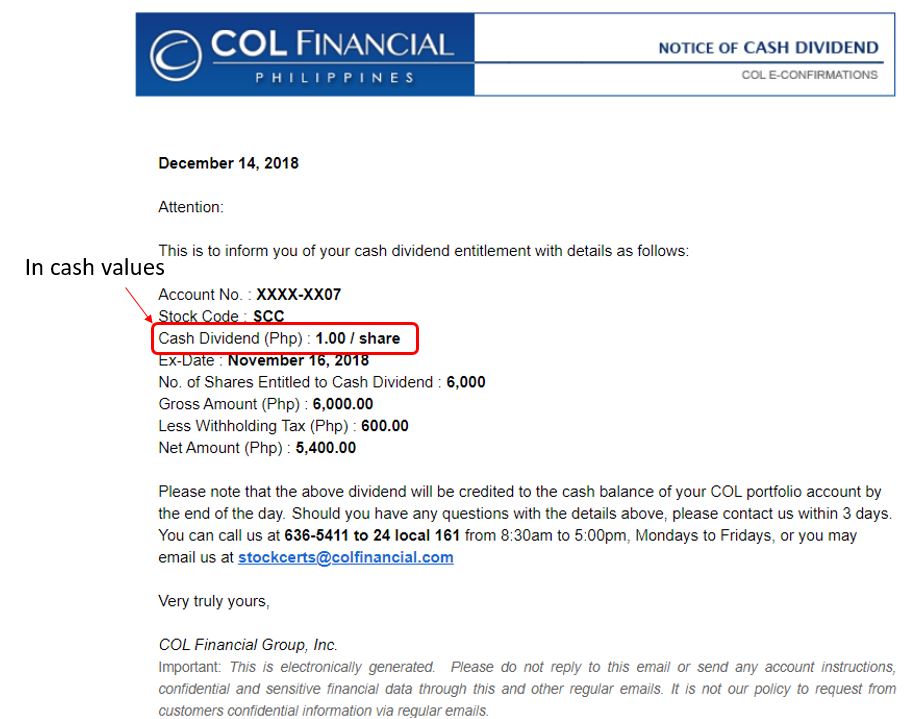

Shareholder owns more than 10 of the REITs stock. 14 of Republic Act No. Check out the REIT dividend payout schedules for AREIT DDMP REIT and FILRT this September 2021.

Since REITs are obliged by law to maintain 33 of the companys share to be owned by public investors and distribute a minimum of 90 of their taxable income to. Ad Looking for a non-traded REIT. Get your free copy of The Definitive Guide to Retirement Income.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Be it enacted by the Senate and House of Representatives of the Philippines in Congress assembled. Ad DividendInvestor is an AwardWinning Dividend Screening Platform.

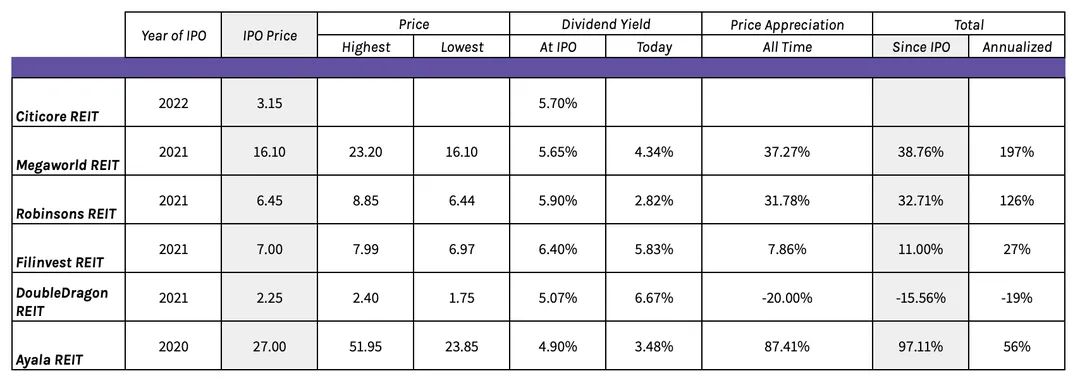

5 tax rate if the corporate shareholder owns at least 10 of the REITs voting stock and in the case of REIT dividends paid to a. The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders. AREIT Ayala Land REIT Inc It is the first REIT in the Philippines.

A real estate investment trust REIT. Dividend yields The biggest. However to-date no REITs have been launched due to two major hurdles that developers have not been willing to accept.

9856 OFWs are exempted from paying the 10 percent dividend tax for seven years beginning January 2020. More than we can fit in this ad. Tax On Dividend Income In The Philippines 2020 Kg Consult Group Inc Reits Real Estate Investment Trusts And.

More so for OFWs who invest in Philippine REITs as theyre exempted from paying the 10 income tax or withholding tax on dividends for. The Bureau of Internal Revenue BIR is set to issue a new regulation upholding the seven-year tax exemption for overseas Filipinos investing in REITs with the date of reckoning. Individuals are imposed with the following dividend tax rates in the Philippines.

REIT legislation was passed in the Philippines ten years ago. A 10 rate if they are citizens or residents of the Philippines. Build a private real estate portfolio with C-REIT.

A Short Lesson On Reit Taxation

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Tax On Dividend Income In The Philippines 2020 Kg Consult Group Inc

Reits The Less Volatile Investment Manila Bulletin

Reits The Less Volatile Investment Manila Bulletin

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

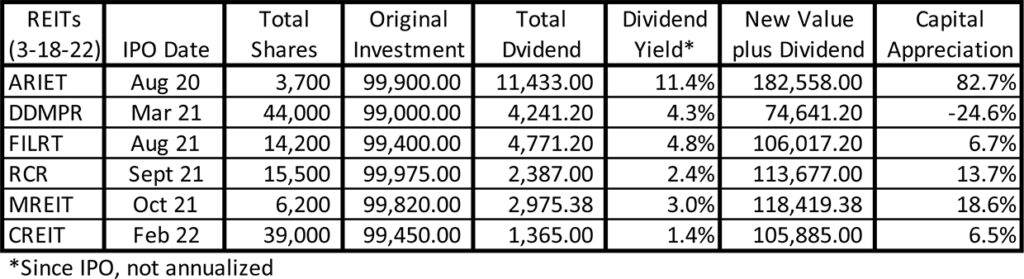

Did You Invest In The Right Reit Property Report

5 Facts About Reit Real Estate Investment Trusts Bodegapik

Areit Should You Buy The Stock Of Ayala Reit Pinoy Money Talk

Upcoming Reit Dividends This September 2021 Reit Philippines

Real Estate Investment Trusts Reits The Next Big Thing In Real Estate Foreclosurephilippines Com

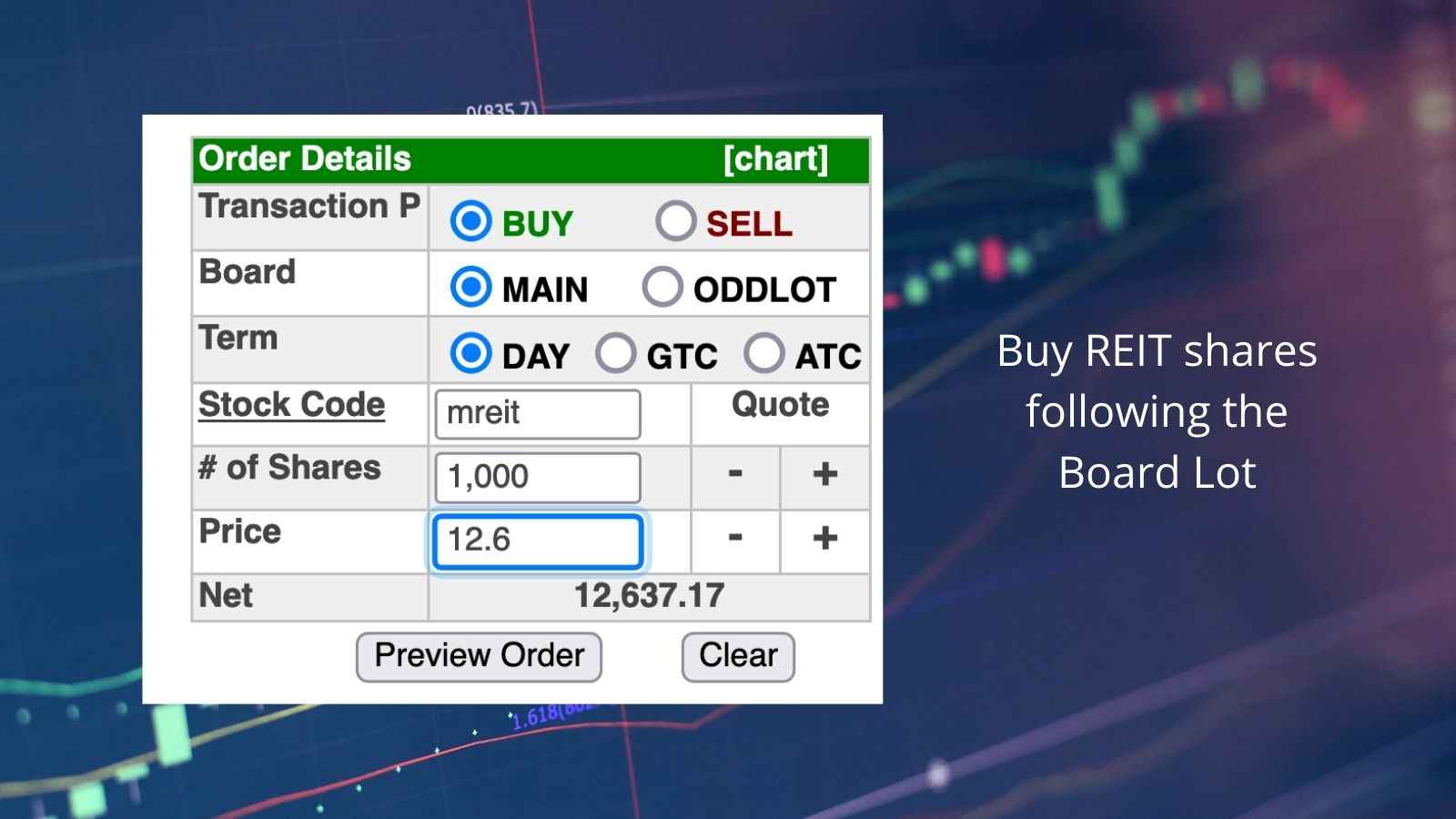

How To Invest In Reits In The Philippines In 2022

Are Reits Finally About To Take Off In The Philippines Magazine Reit Asiapac

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

Solved Final Tax Rates Write The Final Tax Rate Applicable For Each Income If It Is Exempt Write Ex If It Is Subject To Other Income Tax Schemes Course Hero

Gsis Sss Dividend Gains On Areit Ddmp Reit

Reit Investment In The Philippines The Facts You Need To Know Blog Citiglobal

Creit Citicore Reit Reit On Renewables 7 Dividend Yield At Ipo Price Of 2 55 Possible Price Appreciation R Phinvest